Exploring Initial Exchange Offerings (IEOs) in the Blockchain Space

Introduction to Initial Exchange Offerings (IEOs)

Initial Exchange Offerings (IEOs) have emerged as a popular fundraising method in the blockchain space, offering a streamlined approach for blockchain projects to raise capital directly through cryptocurrency exchanges. In this article, we'll delve into the concept of IEOs, their benefits and drawbacks, regulatory considerations, and factors to consider before participating in or launching an IEO.

Understanding IEOs

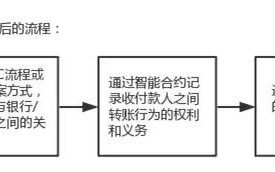

An Initial Exchange Offering (IEO) is a fundraising event conducted on a cryptocurrency exchange platform, where a blockchain project sells its tokens to investors in exchange for cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH). Unlike Initial Coin Offerings (ICOs), where projects independently conduct token sales, IEOs are facilitated by exchanges, which handle the token sale process, marketing, and investor due diligence on behalf of the project.

Benefits of IEOs

1.

Enhanced Credibility

: By conducting their token sales on reputable exchanges, blockchain projects can enhance their credibility and trust among investors, as the exchange acts as a trusted intermediary vetting the projects.2.

Access to Exchange's User Base

: Participating in an IEO enables projects to tap into the existing user base of the exchange, potentially reaching a wider audience of investors.3.

Liquidity

: Tokens issued through IEOs often get listed on the hosting exchange shortly after the token sale, providing immediate liquidity to investors.4.

Security

: Exchanges conduct due diligence on projects before hosting their IEOs, reducing the risk of scams and fraudulent activities compared to standalone ICOs.Drawbacks of IEOs

1.

Centralization

: IEOs rely on centralized exchanges to facilitate token sales, which goes against the decentralized ethos of blockchain technology.2.

Limited Control

: Projects have less control over the token sale process in IEOs, as exchanges dictate the terms and conditions of the offering.3.

Regulatory Risks

: Regulatory uncertainties surrounding cryptocurrency exchanges and token sales pose risks to both projects and investors participating in IEOs.Regulatory Considerations

Regulatory frameworks governing IEOs vary across jurisdictions, with some countries imposing strict regulations on cryptocurrency exchanges and token sales. Before launching or participating in an IEO, it's crucial to consider the regulatory landscape in the relevant jurisdiction to ensure compliance with applicable laws and regulations.

Factors to Consider Before Participating in or Launching an IEO

1.

Exchange Reputation

: Evaluate the reputation and reliability of the hosting exchange, considering factors such as security measures, trading volume, and past IEO performances.2.

Project Viability

: Conduct thorough due diligence on the blockchain project launching the IEO, assessing the team's expertise, project roadmap, technological innovation, and market potential.3.

Tokenomics

: Analyze the tokenomics of the project, including token utility, distribution model, and token allocation, to assess its longterm viability and potential for value appreciation.4.

Regulatory Compliance

: Ensure compliance with regulatory requirements and seek legal counsel to mitigate regulatory risks associated with participating in or launching an IEO.5.

Investment Risk

: Assess the investment risks associated with participating in IEOs, including market volatility, project execution risks, and liquidity concerns.Conclusion

Initial Exchange Offerings (IEOs) have emerged as a popular fundraising mechanism in the blockchain space, offering benefits such as enhanced credibility, access to exchange user base, and liquidity. However, IEOs also pose drawbacks and regulatory risks that warrant careful consideration. Before participating in or launching an IEO, investors and blockchain projects should conduct thorough due diligence and seek professional advice to mitigate risks and ensure compliance with regulatory requirements.